A CIBIL score, which ranges from 300 to 900, is a crucial indicator of an individual’s creditworthiness in India. A score of 600 is often viewed as a threshold that can significantly impact one’s ability to secure loans and credit facilities. This score reflects a history of credit behavior, including repayment patterns, credit utilization, and the types of credit accounts held.

A score of 600 is generally considered below average, which can lead to challenges when seeking financial assistance. Lenders typically perceive individuals with such scores as higher risk, which can result in higher interest rates or outright loan denials. Understanding the implications of a 600 CIBIL score is essential for anyone looking to navigate the financial landscape effectively.

For instance, individuals with this score may find it difficult to obtain personal loans, home loans, or even credit cards. Moreover, if they do manage to secure financing, the terms may not be favorable. This situation can create a cycle of financial strain, as high-interest rates can lead to increased debt burdens.

Therefore, recognizing the importance of improving one’s CIBIL score is vital for long-term financial health and stability.

Key Takeaways

- A 600 CIBIL score is important for accessing credit and loans at favorable terms

- Improving a 600 CIBIL score involves timely payments, reducing credit utilization, and checking for errors in the credit report

- Finding the right lenders for a 600 CIBIL score loan requires research and comparison of interest rates and terms

- When applying for a 600 CIBIL score loan, it’s important to have all necessary documents in order and to avoid applying for multiple loans at once

- Using a 600 CIBIL score loan app can provide convenience and access to multiple lenders, but borrowers should be cautious of high interest rates and fees

How to Improve Your 600 CIBIL Score

Improving a CIBIL score of 600 requires a strategic approach that focuses on responsible credit management and financial discipline. One of the most effective ways to enhance your score is by ensuring timely payments on existing debts. Payment history constitutes a significant portion of the CIBIL score calculation; thus, consistently paying bills on time can lead to gradual improvements.

Setting up reminders or automatic payments can help individuals stay on track and avoid late fees that could further damage their credit profile. Another critical factor in improving a CIBIL score is managing credit utilization. This refers to the ratio of current credit card balances to total available credit limits.

Ideally, individuals should aim to keep their credit utilization below 30%. If someone has a high utilization rate, it may be beneficial to pay down existing balances or request an increase in credit limits from lenders. Additionally, diversifying the types of credit accounts—such as having a mix of secured loans, unsecured loans, and credit cards—can also positively influence the score over time.

Finding the Right Lenders for a 600 CIBIL Score Loan

When seeking a loan with a CIBIL score of 600, it is crucial to identify lenders who are willing to work with individuals in this credit range. Not all financial institutions have the same criteria for lending; some may specialize in providing loans to those with lower credit scores. Researching various lenders, including banks, non-banking financial companies (NBFCs), and online lending platforms, can yield options that are more accommodating to borrowers with a 600 CIBIL score.

In addition to traditional banks, many fintech companies have emerged that cater specifically to individuals with lower credit scores. These lenders often utilize alternative data points and advanced algorithms to assess creditworthiness beyond just the CIBIL score. This approach can provide opportunities for borrowers who may have been overlooked by conventional lenders.

It is essential to compare interest rates, loan terms, and fees across different lenders to find the most favorable options available.

Tips for Applying for a 600 CIBIL Score Loan

| Loan Type | Interest Rate | Tenure | Minimum CIBIL Score |

|---|---|---|---|

| Personal Loan | 12% – 18% | 1-5 years | 600 |

| Car Loan | 8% – 12% | 2-7 years | 600 |

| Home Loan | 6% – 10% | 10-30 years | 600 |

Applying for a loan with a CIBIL score of 600 requires careful preparation and strategic planning. One of the first steps is to gather all necessary documentation that lenders typically require during the application process. This may include proof of income, bank statements, identification documents, and any existing loan agreements.

Having these documents organized can streamline the application process and demonstrate to lenders that you are a responsible borrower. Additionally, it is advisable to be transparent about your financial situation when applying for a loan. Lenders appreciate honesty regarding any past financial difficulties or current obligations.

Providing context about your credit history can help build trust and may lead to more favorable loan terms. Furthermore, consider applying for smaller loan amounts initially; this can increase the likelihood of approval while allowing you to demonstrate your ability to repay the loan responsibly.

Benefits of Using a 600 CIBIL Score Loan App

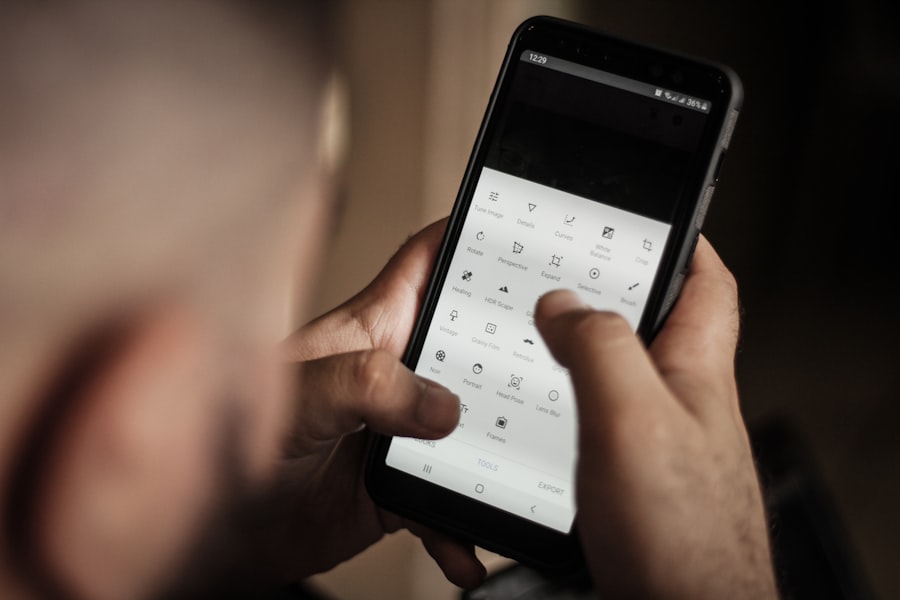

In today’s digital age, utilizing a loan app designed for individuals with a 600 CIBIL score can offer numerous advantages. These apps often provide a user-friendly interface that simplifies the loan application process. Users can apply for loans from the comfort of their homes without the need for extensive paperwork or in-person visits to banks.

This convenience is particularly beneficial for those who may have busy schedules or limited access to traditional banking services. Moreover, many loan apps offer features such as instant approval and disbursement of funds, which can be crucial in times of financial urgency. The speed at which these apps operate allows borrowers to access funds quickly, enabling them to address immediate financial needs without prolonged waiting periods.

Additionally, some apps provide personalized loan recommendations based on individual financial profiles, helping users make informed decisions about their borrowing options.

Common Misconceptions about 600 CIBIL Score Loans

There are several misconceptions surrounding loans available for individuals with a 600 CIBIL score that can lead to confusion and misinformation. One prevalent myth is that all lenders will automatically reject applications from individuals with scores below 650. While it is true that many traditional banks may have stringent criteria, numerous alternative lenders are willing to consider applicants with lower scores.

These lenders often focus on other factors such as income stability and repayment capacity rather than solely relying on the CIBIL score. Another common misconception is that obtaining a loan with a low CIBIL score will always result in exorbitant interest rates. While it is likely that borrowers with lower scores may face higher rates compared to those with excellent credit histories, this does not mean that all loans will be prohibitively expensive.

By shopping around and comparing offers from various lenders, borrowers can find competitive rates that align with their financial capabilities.

Managing Your Finances with a 600 CIBIL Score Loan

Once an individual secures a loan despite having a 600 CIBIL score, effective financial management becomes paramount. Establishing a budget that accounts for monthly loan repayments alongside other living expenses is essential for maintaining financial stability. This budget should prioritize debt repayment while also allowing for savings and discretionary spending within reasonable limits.

Additionally, borrowers should consider setting up an emergency fund to cover unexpected expenses that may arise during the loan repayment period. Having this safety net can prevent individuals from falling behind on payments due to unforeseen circumstances such as medical emergencies or job loss. Regularly reviewing one’s financial situation and adjusting budgets as necessary can help ensure that loan obligations are met without compromising overall financial health.

Alternatives to 600 CIBIL Score Loans

For individuals who find themselves unable or unwilling to pursue loans with a 600 CIBIL score, several alternatives exist that may provide necessary financial support without the drawbacks associated with high-interest loans. One option is seeking out secured loans, where collateral is provided against the borrowed amount. Because these loans pose less risk to lenders, they often come with lower interest rates and more favorable terms.

Another alternative is exploring peer-to-peer lending platforms that connect borrowers directly with individual investors willing to fund loans based on personal stories rather than solely on credit scores. These platforms often consider factors such as employment history and income potential when evaluating applications. Additionally, individuals might consider seeking assistance from family or friends who may be willing to lend money at more favorable terms than traditional lenders would offer.

In conclusion, navigating the world of loans with a 600 CIBIL score requires understanding its implications and taking proactive steps toward improvement and responsible management. By leveraging available resources and exploring various lending options, individuals can find pathways toward achieving their financial goals despite initial challenges posed by their credit scores.

FAQs

What is a 600 CIBIL score loan app?

A 600 CIBIL score loan app is a mobile application that provides loans to individuals with a CIBIL score of 600 or above. The app uses the CIBIL score as one of the criteria for determining the eligibility of the individual for a loan.

How does a 600 CIBIL score loan app work?

A 600 CIBIL score loan app works by allowing individuals to apply for loans through the app. The app uses the individual’s CIBIL score, along with other factors, to determine the loan amount and interest rate that the individual is eligible for. Once approved, the loan amount is disbursed to the individual’s bank account.

What are the eligibility criteria for a 600 CIBIL score loan app?

The eligibility criteria for a 600 CIBIL score loan app may vary from app to app, but generally, individuals need to have a CIBIL score of 600 or above to be eligible for a loan. Other criteria may include age, income, employment status, and credit history.

What are the benefits of using a 600 CIBIL score loan app?

The benefits of using a 600 CIBIL score loan app include quick and convenient access to loans, competitive interest rates, and the ability to improve one’s credit score by making timely repayments. Additionally, the app may offer flexible repayment options and minimal documentation requirements.

Are there any drawbacks to using a 600 CIBIL score loan app?

Some potential drawbacks of using a 600 CIBIL score loan app may include higher interest rates compared to traditional bank loans, limited loan amounts, and the possibility of falling into a debt trap if the loan is not managed responsibly. It is important for individuals to carefully consider their financial situation before applying for a loan through the app.