In an increasingly digital world, financial services have evolved to meet the needs of a younger demographic, particularly those stepping into adulthood at the age of 18. This age marks a significant transition, as young individuals often find themselves facing new financial responsibilities, such as tuition fees, rent, and other living expenses. Loan apps designed specifically for this age group have emerged as a convenient solution, providing quick access to funds with minimal barriers.

These applications not only offer financial assistance but also serve as a gateway to understanding credit and personal finance management. The rise of loan apps has been fueled by the growing acceptance of technology in everyday life. With smartphones becoming ubiquitous, young adults are more inclined to seek financial solutions through mobile applications rather than traditional banking methods.

This shift has led to the development of user-friendly platforms that cater to the unique needs of 18-year-olds, allowing them to navigate their financial journeys with greater ease. However, while these apps can provide immediate relief, it is crucial for young borrowers to understand the implications of taking on debt at such a formative stage in their lives.

Key Takeaways

- Loan apps can provide financial assistance to 18-year-olds who may not have access to traditional loans.

- Financial assistance at 18 can help young adults build credit and learn responsible borrowing habits.

- Top loan apps for 18-year-olds offer features like low interest rates, flexible repayment options, and educational resources.

- When choosing a loan app, consider factors such as interest rates, fees, customer service, and user reviews.

- Responsible borrowing and repayment involve understanding the terms of the loan, budgeting for payments, and avoiding excessive borrowing.

Understanding the Importance of Financial Assistance at 18

At 18, many individuals are embarking on their journey into higher education or entering the workforce for the first time. This transitional phase often comes with significant financial challenges. For students, tuition fees can be daunting, and living expenses may exceed their limited income from part-time jobs.

Financial assistance through loans can alleviate some of these pressures, enabling young adults to focus on their studies or career development without the constant worry of financial instability. Moreover, obtaining a loan at this age can serve as an important stepping stone toward building a credit history. Establishing credit early on can have long-term benefits, such as better interest rates on future loans and increased chances of approval for credit cards or mortgages.

However, it is essential for young borrowers to approach this opportunity with caution. Understanding the terms and conditions of loans, including interest rates and repayment schedules, is vital to ensure that they do not fall into a cycle of debt that could hinder their financial future.

Top Loan Apps for 18-Year-Olds: Features and Benefits

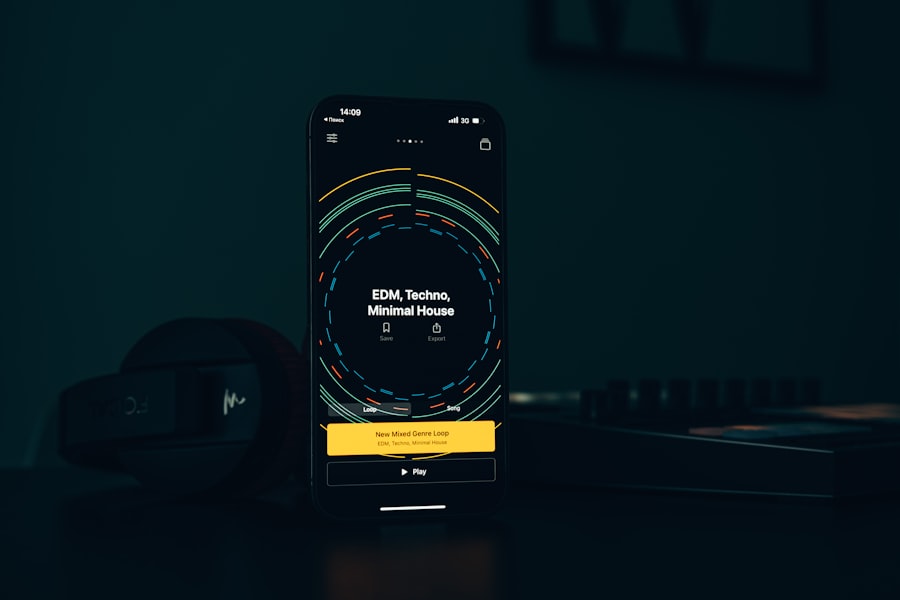

Several loan apps have gained popularity among 18-year-olds due to their accessibility and user-friendly features. One notable example is Earnin, which allows users to access their earned wages before payday without incurring traditional loan fees. Instead of interest, users can choose to leave a tip based on the service they received.

This model appeals to young adults who may be wary of high-interest loans and prefer a more flexible repayment option. Another prominent app is Cash App, which not only facilitates peer-to-peer money transfers but also offers a Cash Card that allows users to spend their balance anywhere that accepts Visa. Cash App also provides users with the option to invest in stocks and Bitcoin, making it a versatile tool for managing finances.

The app’s simplicity and integration of various financial services make it particularly attractive to younger users who are looking for comprehensive solutions in one place.

How to Choose the Right Loan App for Your Needs

| Loan App | Interest Rate | Loan Amount | Repayment Period | Approval Time |

|---|---|---|---|---|

| App A | 5% | 500 – 5000 | 6 – 36 months | 24 hours |

| App B | 6% | 1000 – 10000 | 12 – 48 months | 48 hours |

| App C | 4.5% | 200 – 3000 | 3 – 24 months | 12 hours |

Selecting the right loan app requires careful consideration of several factors. First and foremost, potential borrowers should assess their specific financial needs. Are they looking for a small loan to cover immediate expenses, or do they need a larger sum for educational purposes?

Understanding the amount required will help narrow down options and identify apps that cater specifically to those needs. Additionally, it is crucial to evaluate the terms and conditions associated with each app. This includes interest rates, repayment periods, and any associated fees.

Some apps may offer more favorable terms than others, making it essential for young borrowers to conduct thorough research before committing. Reading user reviews and seeking recommendations from peers can also provide valuable insights into the reliability and customer service quality of different loan apps.

Tips for Responsible Borrowing and Repayment

Responsible borrowing is paramount for 18-year-olds who are just beginning to navigate the world of personal finance. One key tip is to borrow only what is necessary. It can be tempting to take out more than needed, especially when faced with enticing offers from loan apps.

However, borrowing more than one can afford to repay can lead to financial strain and negatively impact credit scores. Creating a budget is another essential practice for young borrowers. By tracking income and expenses, individuals can gain a clearer understanding of their financial situation and determine how much they can realistically allocate toward loan repayments each month.

Setting up automatic payments can also help ensure that payments are made on time, reducing the risk of late fees and damage to credit scores.

Alternatives to Loan Apps for 18-Year-Olds

Exploring Alternative Financial Options

While loan apps provide a convenient option for financial assistance, they are not the only avenue available to 18-year-olds seeking funds. Traditional banks and credit unions often offer student loans or personal loans with competitive interest rates. These institutions may also provide financial education resources that can help young borrowers make informed decisions about their finances.

Financial Aid Opportunities

Additionally, scholarships and grants are excellent alternatives that do not require repayment. Many organizations offer financial aid based on academic performance, extracurricular involvement, or specific demographics.

Reducing Financial Burden

Researching available scholarships can significantly reduce the financial burden associated with education and living expenses.

Common Mistakes to Avoid When Using Loan Apps

Navigating loan apps can be fraught with pitfalls, especially for inexperienced borrowers. One common mistake is failing to read the fine print before agreeing to loan terms. Many young adults may overlook critical details regarding interest rates or repayment schedules, leading to unexpected costs down the line.

It is essential to take the time to understand all aspects of the loan agreement fully. Another frequent error is neglecting to consider the long-term implications of borrowing. Young borrowers may focus solely on immediate needs without contemplating how taking on debt will affect their future financial health.

Developing a clear repayment plan before taking out a loan can help mitigate this risk and ensure that borrowers remain on track financially.

Empowering 18-Year-Olds with Financial Knowledge and Resources

As 18-year-olds step into adulthood, equipping them with financial knowledge and resources is crucial for fostering responsible borrowing habits. Loan apps can serve as valuable tools in this journey, offering quick access to funds while also providing opportunities for learning about credit management. However, it is imperative that young borrowers approach these resources with caution and awareness.

By understanding their financial needs, evaluating loan options carefully, and practicing responsible borrowing habits, 18-year-olds can navigate their financial landscape more effectively. Additionally, exploring alternatives such as scholarships or traditional loans can provide further support without the burden of high-interest debt. Ultimately, empowering young adults with knowledge about personal finance will enable them to make informed decisions that positively impact their futures.

FAQs

What is the best loan app for 18 year olds?

The best loan app for 18 year olds will depend on individual financial needs and credit history. Some popular loan apps for young adults include MoneyLion, Chime, and Branch.

What are the eligibility requirements for 18 year olds to get a loan through an app?

Eligibility requirements for 18 year olds to get a loan through an app may include having a steady source of income, a valid bank account, and a minimum credit score. Each loan app will have its own specific eligibility criteria.

What are the typical loan amounts and interest rates for 18 year olds using loan apps?

Loan amounts and interest rates for 18 year olds using loan apps can vary widely. Some loan apps may offer small, short-term loans with higher interest rates, while others may provide larger loan amounts with more competitive rates. It’s important for 18 year olds to compare different loan apps to find the best terms for their needs.

Are there any risks associated with using loan apps for 18 year olds?

Using loan apps as an 18 year old can come with risks, such as high interest rates, potential impact on credit scores, and the temptation to borrow more than necessary. It’s important for young adults to carefully consider the terms and conditions of any loan app before borrowing money.

What are some alternatives to using loan apps for 18 year olds?

Alternatives to using loan apps for 18 year olds may include seeking financial assistance from family or friends, applying for a traditional bank loan, or exploring other forms of financial aid such as scholarships or grants. It’s important for young adults to consider all options before taking on debt through a loan app.